haven't filed taxes in 10 years canada

If you earned this money while out of the country for greater than 2 years you are not required to file a return on it. People may get behind on their taxes unintentionally.

How To File Overdue Taxes Moneysense

If you go to genutax httpsgenutaxca you can file previous years tax returns.

. Get all your T-slips and what ever. Learn what to do if you havent done taxes in a while. For each month that you do not file.

Further the CRA does not go back greater than 7 years. How far back can you go to file taxes in Canada. I havent filed taxes in.

Answer 1 of 24. You will owe more than the taxes you didnt pay on time. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month.

Ask a Canada Law Question Get an Answer ASAP. Sometimes they havent filed for 10 years or more. Failure to file a tax return.

Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. A CRA cant collect an outstanding debt if you fail to pay what it owes within a certain amount of time. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date.

What happens if you havent filed taxes in 10 years Canada. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of. The longer you go without filing.

You owe fees on the. Have you been contacted by or acted upon Canada. That said youll want to contact them as soon as.

Up to 15 cash back Canada Law. Start with the 2018 one and then go back to 2009 and work your way back. After May 17th you will lose the 2018 refund as the statute of limitations.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late filing penalty of 5 percent of the tax owing. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness. Filing Taxes Late In Canada.

Individuals who owe taxes for 2017 have to pay by april 30 2018. Contact the CRA. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

You are not the only person to have gone years without submitting. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. Get in contact with an accountant who specializes in taxes explain the situation and get your paperwork in.

All sorts of people put off filing their tax returns and thats a serious problem says Simpson. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Perhaps there was a death in the family or you suffered a serious illness.

If you havent filed taxes in a few years the CRA will find out sooner or later. It is common for tax debts to have a collectors limitation of either six. Connect one-on-one with 0 who will answer your question.

Theres that failure to file and failure to pay penalty. According to the cra a taxpayer has 10 years from the end of a calendar year to file an income tax return. You will also be required to pay penalties for non-compliance.

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. Whatever the reason once you havent filed for.

Expats Get Back On Track With Us Tax

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Here S What To Do If You Missed The April 18 Tax Filing Deadline

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Taxes 2022 Is There A Penalty For Filing Taxes Late And Other Last Minute Irs Tax Filing Tips Abc7 Chicago

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Haven T Filed Taxes In 14 Years Canada Ictsd Org

What Happens If I Haven T Filed Taxes In Years H R Block

Here S What Happens When You Don T File Taxes

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

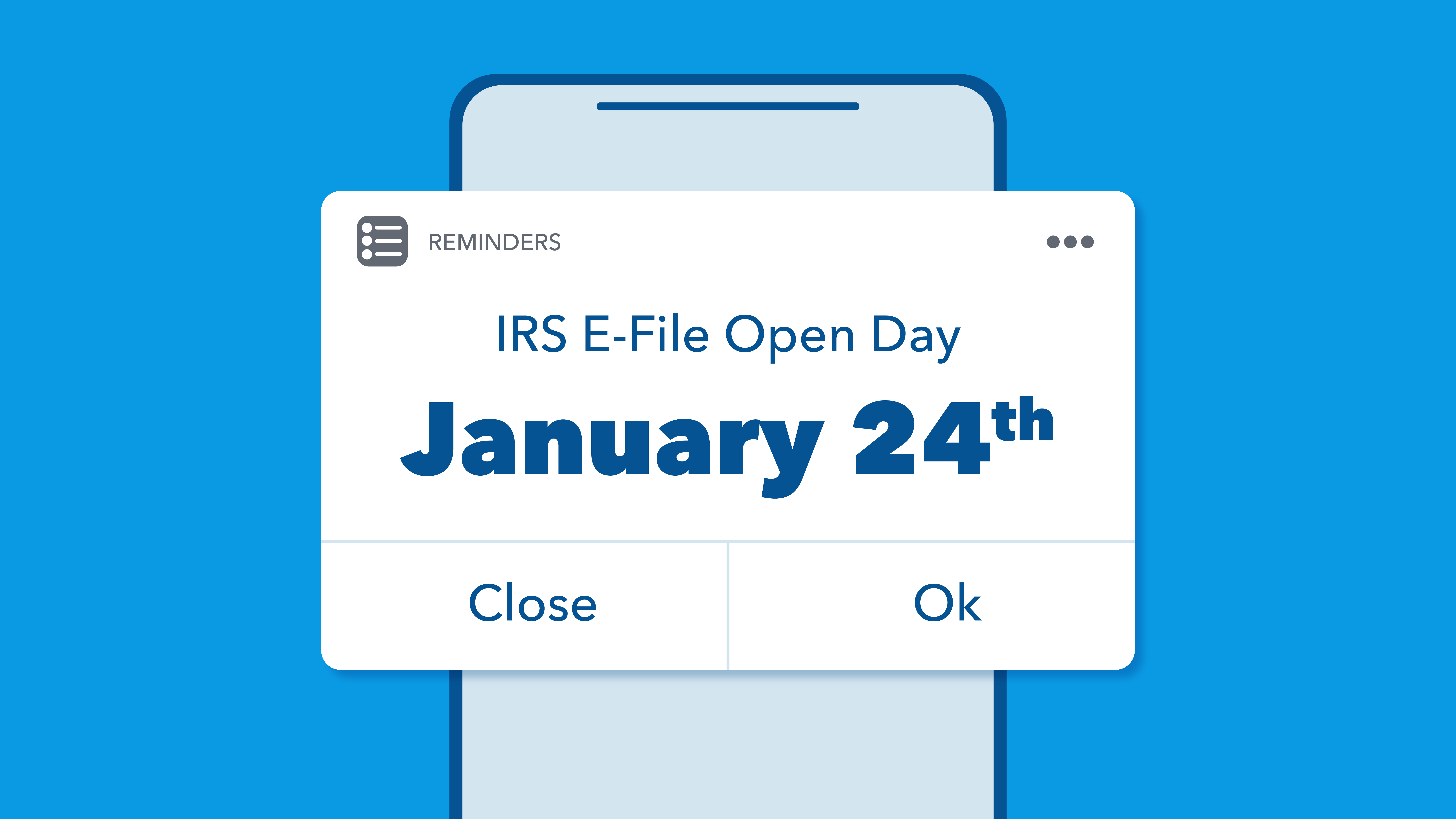

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

How Many Years Can I Go Without Filing Taxes Canada Ictsd Org

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Grand Prince Hotel Mirpur 1216 Dhaka World Hotel Reviews Hotel Reviews Hotel Outdoor Swimming Pool

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law