nassau county property tax rate

The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median. What is the Suffolk County Property Tax Rate.

Property Tax On Long Island Nassau Vs Suffolk Plainview Ny Patch

While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be.

. Under the county level almost all local governments have arranged for Nassau County to bill and collect the tax. Payment by credit card will incur a convenience fee of 23 of your total tax payment. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

If your market value is 500000 the local assessment office will. Learn all about Nassau County real estate tax. Nassau County Department of Assessment 516 571.

Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property. In Suffolk County the average tax rate is 237 according to SmartAsset. 2022 Homeowner Tax Rebate Credit Amounts.

What Is the Nassau County Property Tax Rate. The Tax Records department of the Treasurers Office maintains all records of and collects payments on delinquent Nassau County Property Taxes. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of. Nassau County collects on average 074 of a propertys assessed. The Property Appraisers office determines the assessed value and exemptions on the tax roll.

Nassau County FL Property Appraiser. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The New York Comptrollers.

Nassau County collects on average 179 of a propertys assessed. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your. Pay Delinquent Property Taxes.

This is the total of state and county sales tax rates. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

Long Island property tax is among the countrys highest due to high home prices and high tax rates. If the check amount. Every entity establishes its own tax rate.

Nassau County New York. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. You may pay your current tax bill by credit card or electronic check online.

If you need to discuss these amounts contact the Property Appraisers office or visit their. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your.

New York Property Tax Calculator Smartasset

All The Nassau County Property Tax Exemptions You Should Know About

Property Taxes 1995 2015 Cdrpc

Receiver Of Taxes Town Of Oyster Bay

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

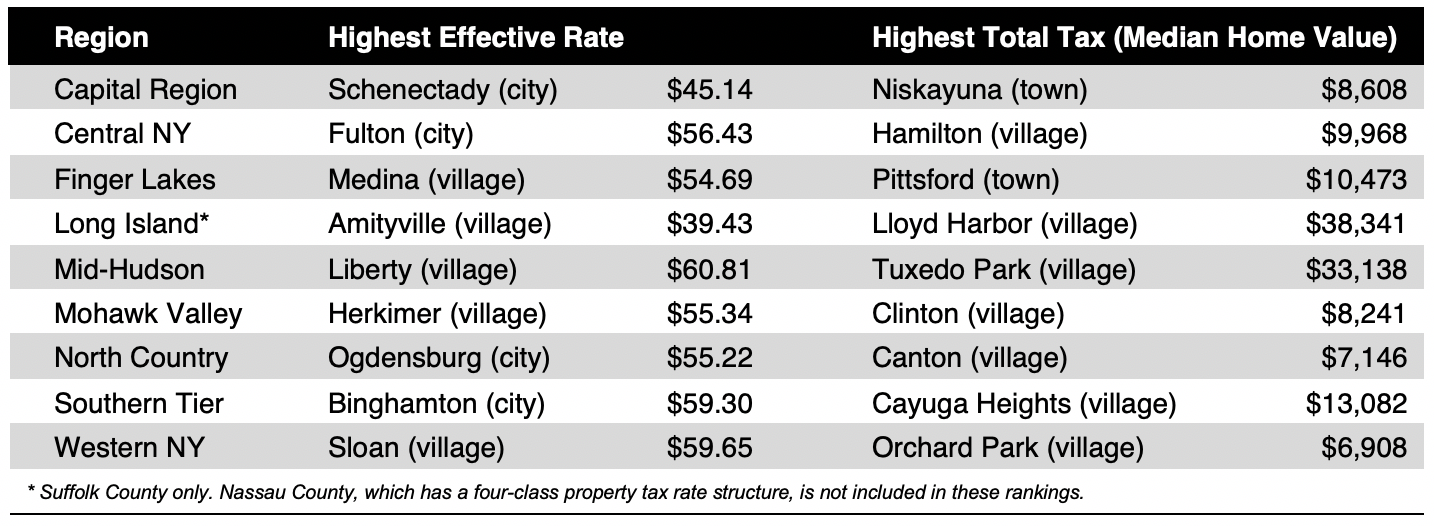

Property Taxes In Nassau County Suffolk County

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

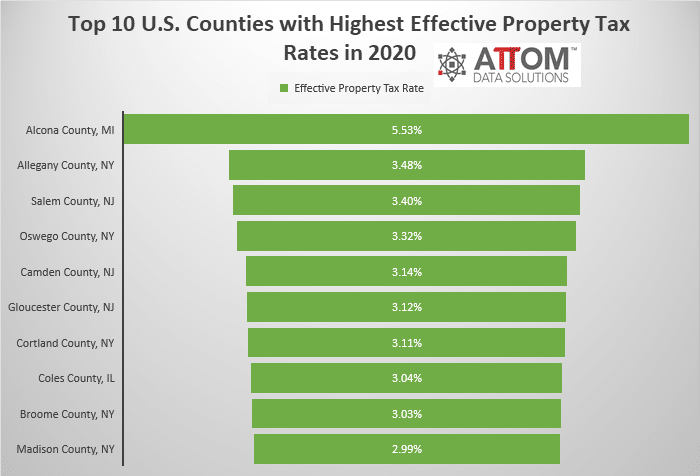

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

Tax Exemption Saves Owners Of New Homes In Nassau County

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Tax By County Property Tax Calculator Rethority

Property Taxes On Li Are Some Of The Highest In The Country Huntington Ny Patch

Property Taxes By County Interactive Map Tax Foundation

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

:max_bytes(150000):strip_icc():gifv()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png)